Min. Investment

$100,000

What is a Separately Managed Account?

A Separately Managed Account (SMA) provides the transparency of a traditional brokerage account, while offering turnkey access to internationally-diversified portfolios of global equities and fixed income, professionally managed by the Euro Pacific Advisors investment committee.

Day-to-day investment decisions are delegated to Euro Pacific Advisors, thus relieving you of the burden of reacting to fast moving-markets, changing economic circumstances, and time-consuming administration. Simply track all of your trades online and watch your portfolio grow in real-time.

Available Strategies

To view recent Fact Sheets, please click the links below.

| Strategy | Risk Profile | Return 2016 | Return 2017 | Volatility¹ | Holdings² |

|---|---|---|---|---|---|

| Moderate | Low-Medium | +2.48% | +7.11% | 8% | 818 |

| Balanced | Medium | +2.57% | +9.73% | 12% | 818 |

| Growth | Medium-High | +5.06% | +14.87% | 14% | 852 |

| Aggressive Growth | High | +14.04% | +15.11% | 18% | 117 |

| Natural Resources | High | +22.47% | +11.07% | 20% | 81 |

| Gold & Precious Metals | High | +46.79% | +7.40% | 32% | 94 |

¹The average risk (defined by annual Target Volatility) of your portfolio will vary; please read Fact Sheet “Variability of Returns” section

²Number of holdings as of the end of 2016

The Management Team

Euro Pacific Advisors Ltd. manages its Separately Managed Accounts (SMAs) and Mutual Funds through a sub-advisory management agreement with a 150-year-old, European financial services company that provides investment and advisory services to institutional and corporate clients internationally.

- The company advising Euro Pacific Advisors directly manages £2.5bn+ in client assets.

- The team advising Euro Pacific Advisors is led by three investment managers with over 60 years’ combined industry experience and specialisms in risk-management, technical analysis, and global funds.

Investment Process

Ensuring Suitability

Euro Pacific Advisors determines your specific strategy allocations and weighting by adhering to a structured, comprehensive review of your particular risk tolerance, experience, and several other relevant factors. Individual preferences and needs are taken into serious consideration as portfolios are crafted.

Core vs. Tactical Component

Euro Pacific Advisors employs an innovative investment approach whereby typically 80% of your portfolio – the Core component – will be invested primarily in exchange-traded funds (ETFs) to provide you with exposure to a number of different asset classes including equities, fixed income, commodities, and cash globally.

The Tactical component composed of the remaining 20% will be invested to enhance returns by exploiting shorter-term opportunities and special situations, including Initial Public Offerings and takeover scenarios. This element of the portfolio may also be used to hedge equity exposure through equity indices or sectors.

Investment decisions are made by the professional managers and guided by a variety of internal and external information sources. Investments are governed by parameters to reduce risk and monitored accordingly.

Maximum Diversification

After meticulous selections of exchange-traded funds (ETFs) and direct stock investments, strategies can maintain upwards of 800 underlying securities spanning different countries and sectors, achieving both the high level of diversification and the lower volatility that is desired when building a global, long term portfolio, all while minimizing brokerage commissions.

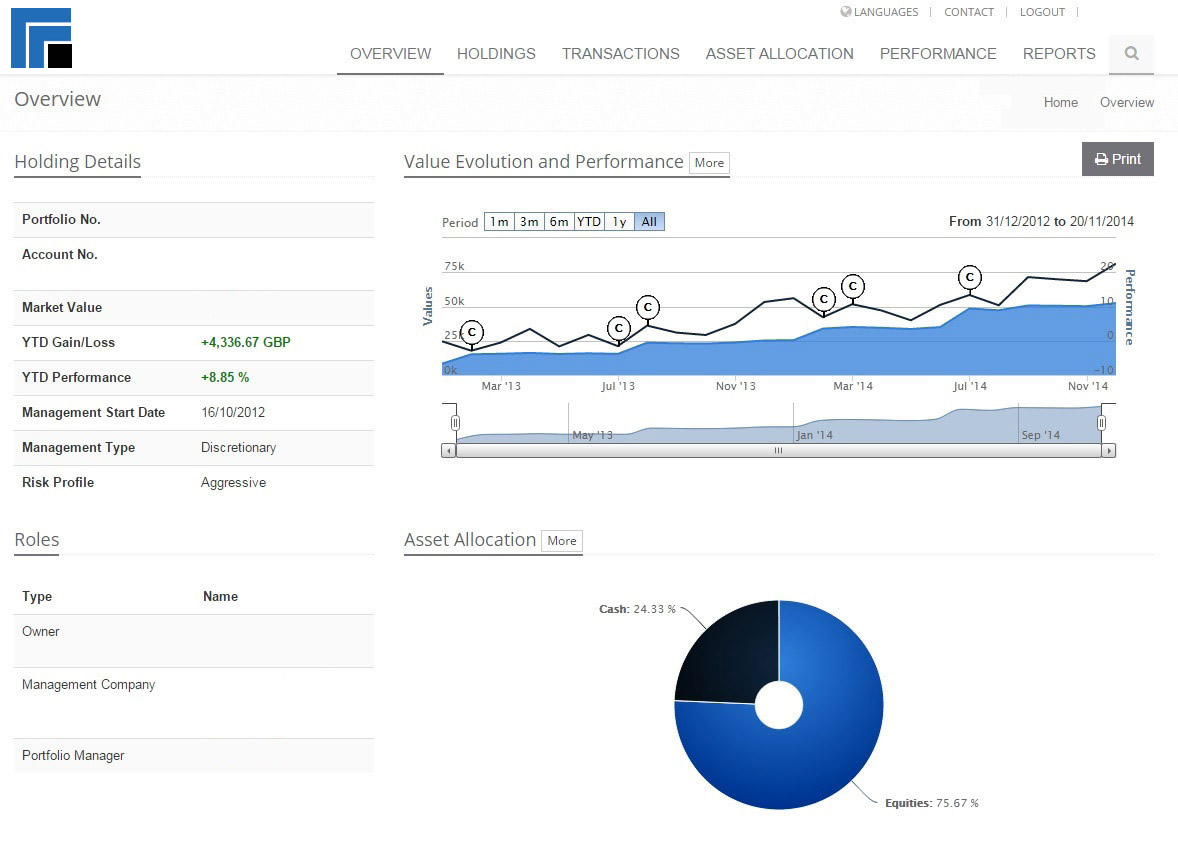

Complete Transparency

Separately Managed Account holders can view their portfolios and statements at any time through the Client Portal.